On December 6, 2022, CMS hosted an online webinar addressing NGHP Section 111 reporting issues. The first half of the webinar covered concerns and points of interest from CMS’s point of view and the second half was a Q&A session fielding attendee concerns.

We heard a varied list of CMS’s concerns with the quality (and capability) of reporting that they are seeing. Angel Pagan, EDI Director at BCRC, pointed out that many of the points and procedures he was explaining in the webinar are outlined in the NGHP User Guide. Nevertheless, industry confusion prompted CMS to cover these topics in a webinar.

Some Takeaways, Reminders, and Points of Interest

- Indemnity-only settlements that do not release medicals do not need to be reported under Section 111 as TPOCs (total payment obligation to the claimant).

- Property damage amounts should be included in the TPOC amount if those amounts are part of a single settlement that has the effect of releasing medicals.

- The Event Table in Section 6.6.4 of Chapter IV of the NGHP User Guide has details on many common TPOC scenarios and is a good reference for RREs.

- Situations where ORM terminates for one injury but continues for another were covered. To properly report these situations:

- If there is no settlement, the ICD codes must be updated to reflect the continuing injury only, leaving ORM open until it terminates.

- If there is a settlement (TPOC) for one injury that terminates ORM, then the original report is updated with the ICD codes for the continuing injury and the ICD codes for the settlement are moved to a new claim record with the TPOC amount.

- Section 6.3 in Chapter III of the NGHP User Guide is a helpful guide to ORM reporting.

CMS Errors

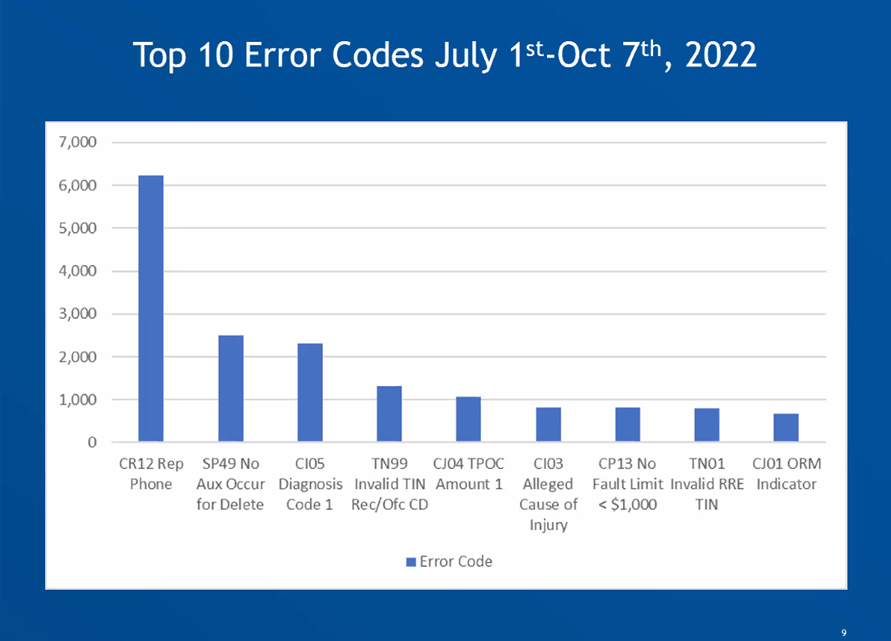

One interesting segment was a view of the top ten error codes (though, humorously, the chart only showed nine) CMS has seen over the past quarter.

Another notable pair was the prevalence of CI05 and CI03 on the list. Their presence highlights that it is still common for CMS to receive invalid ICD-9 or ICD-10 codes on their submissions. CMS publishes a list of the acceptable ICD codes, which enables RREs to verify the codes they are submitting are acceptable. Section 111 vendors (like APP Tech) include validation checks to verify the correctness of ICD codes before claims are sent to CMS.

Additional slides in the presentation were dedicated to explaining technical bits about how ICD codes should be reported. It’s surprising that many claims are still reported with invalid ICD codes, given the prevalence of technology to assist with accurate reporting.

TPA Transfers

Two scenarios for moving claims from one TPA to another were reviewed. Although discussing a routine happening, the second scenario may have been confusing for some in the audience new to Section 111. This slide implied the Policy Number always changes when TPAs change and therefore it was necessary to send DELETE-ADD transactions to CMS for all claims when a new TPA takes over claims from another. It wasn’t quite clear from the slide that this only applies if one of the Section 111 “key fields” is changing (e.g. policy number). Mr. Pagan elaborated on this point during the Q&A segment, but we hope they clarify the slide before releasing the final deck on CMS’s website.

Upcoming Changes to the CP13 No-Fault Error Code

CMS flags a CP13 soft error for claims where the submitted No-Fault Limit is under $1,000. This is to help RREs identify incorrectly submitted no-fault claim limits. However, there are many policies (they noted motorcycle policies as an example) where the limits are less than $1,000 and this is causing many false positives. Therefore, effective January 2023, the threshold for triggering the CP13 error code is dropping to $500. This should be a relief for RREs that are currently reviewing many of these errors.

Here to Help

APP Tech is a leading provider of NGHP Section 111 Reporting Services via its MIR Express™ reporting platform. If you have questions about the CMS webinar or anything related to MMSEA Section 111, let us know. We’re here to help!

Update 12/15/2022: CMS posted the slides for the webinar on their website. You can access the complete slide deck with talking points here.